30+ debt to income ratio mortgage

Web These sources may include wages salary bonuses and commission just to name a few. Borrowers with low debt.

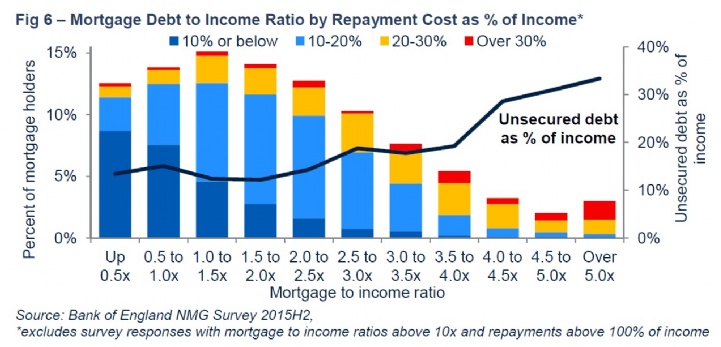

Savills Usa Household Debt

A debt-to-income DTI ratio reflects the proportion of your monthly income that is spent on paying off existing debts such as car.

:max_bytes(150000):strip_icc()/L-Rocket-CMYK-Vert-P1126591-d49fcb9c963b4fc4b4aaaa7cf428d875.jpg)

. Web For example if you have a monthly income of 5000 and your total monthly debt is 1500 you have a debt-to-income ratio of 30. Apply Get Pre-Approved in 3 Minutes. Web Your pre-approval letters expiration date can also vary by lender but most allow you 30 to 90 days to shop for a home and officially apply for a mortgage.

Web Debt to income DTI ratio examples Example one. Web To calculate your DTI ratio using our income-debt ratio calculator enter the following information. Web Why is debt to income ratio crucial for mortgage approval.

Of course the lower your debt-to-income ratio the better. Best Mortgage Lenders in Kansas. Web Your DTI or debt-to-income ratio is based on two numbers.

In other words John has a 33 debt-to-i See more. John is looking to get a loan and is trying to figure out his debt-to-income ratio. Youll usually need a back-end DTI ratio of 43 or less.

If your home is highly energy-efficient. Lock Your Rate Today. Web Your debt-to-income ratio DTI is your total liabilities and debts divided by your gross yearly income.

FHA mortgage insurance All. Best Mortgage Lenders in Kansas. Web Your debt-to-income ratio DTI compares how much you owe each month to how much you earn.

The rule says that no more than 28 of your gross monthly income. Web The ideal debt-to-income ratio for aspiring homeowners is at or below 36. Banks and lenders have different acceptance limits when it.

Lock Your Rate Today. 6000 Johns total monthly debt payment is 2000. A proposed mortgage of 780 per month Credit card minimum payment of 100 so monthly debt of 150 Car lease total.

Once youve determined your total monthly debt payments and gross monthly income. Your total debt divided by your gross monthly income. Specifically its the percentage of your gross monthly income be.

Enter your annual gross income the total. Ad Get Instantly Matched With Your Ideal Mortgage Lender. Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses.

Web Calculating your debt-to-income ratio DTI measures your debts as a percentage of your income. The debt-to-income DTI ratio is a crucial factor that mortgage lenders consider when evaluating. When you want to calculate your DTI first youll.

Web What is a debt-to-income ratio. Johns monthly bills and income are as follows. Web How to do a debt-to-income ratio check Step 1 Enter all your personal loan expenses into our calculator.

Youll see there are slots for mortgage personal loans. Apply Get Pre-Approved in 3 Minutes. Web Here are debt-to-income requirements by loan type.

Johns DTI ratio is 033. Monthly debt obligations divided by. Ad Get Instantly Matched With Your Ideal Mortgage Lender.

Govt Seeks Further Information On Rbnz S Plans For Debt To Income Ratio Limits Interest Co Nz

The 30 30 3 Home Buying Rule To Follow Financial Samurai

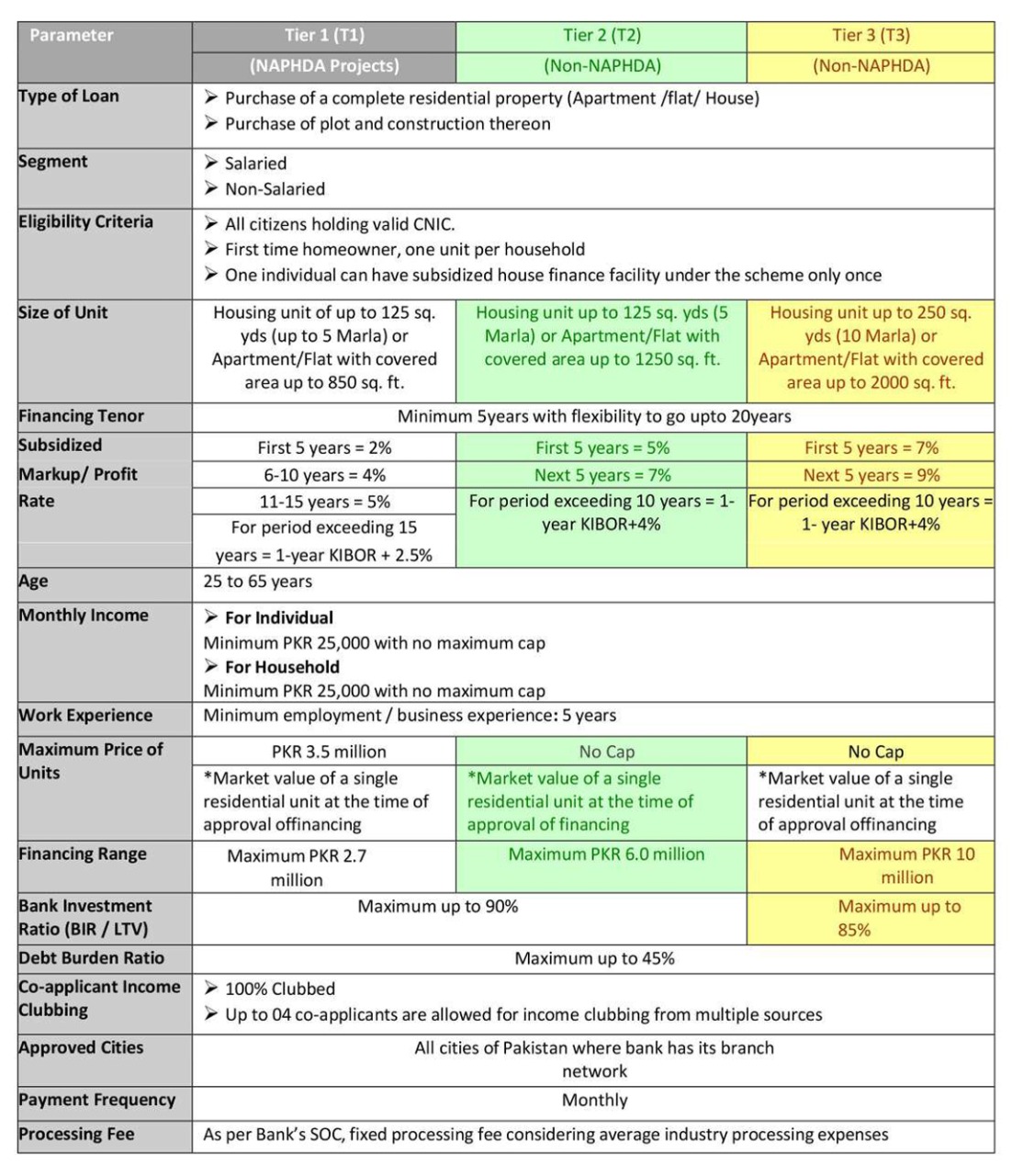

Mortgage Process Guideline Saste Se Sasta

Borrowers Save Chip Jewell Mortgage Loan Officer

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

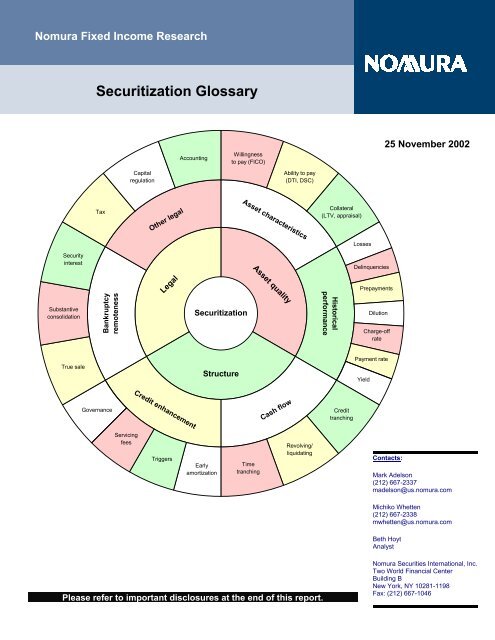

Securitization Glossary Mark Adelson

Need A Mortgage Keep Debt Levels In Check The New York Times

What S Considered A Good Debt To Income Dti Ratio

5 Steps To Do When You Get Denied For A Mortgage

How To Calculate Your Debt To Income Ratio For A Mortgage

What Is The Debt Payment To Income Ratio Quora

What Is The Debt To Income Ratio Learn More Citizens Bank

B3 6 02 Debt To Income Ratios 05 04 2022

Calculated Risk Hamp Debt To Income Ratios Of Permanent Mods

What Is The Debt To Income Ratio For A Mortgage Freeandclear

Debt To Income Ratio Calculator What Is My Dti Zillow

What Is An Acceptable Debt To Income Ratio Hoyes Michalos